Blogs

Such spins are happy-gambler.com click to read usually simply for certain game, therefore look at the conditions and terms very first. Personal gambling enterprises give $step one put welcome bundles for brand new professionals. Constantly, you will get plenty if not millions of gold coins to make use of while the digital money on the website otherwise application. Read the finest Bitcoin casinos on the internet for 2025 and you may join all of our best website today. Find out more about Bitcoin gaming and the ways to get started with Bitcoins.

Choosing the Harmony: Renal State and you will Large Phosphorus

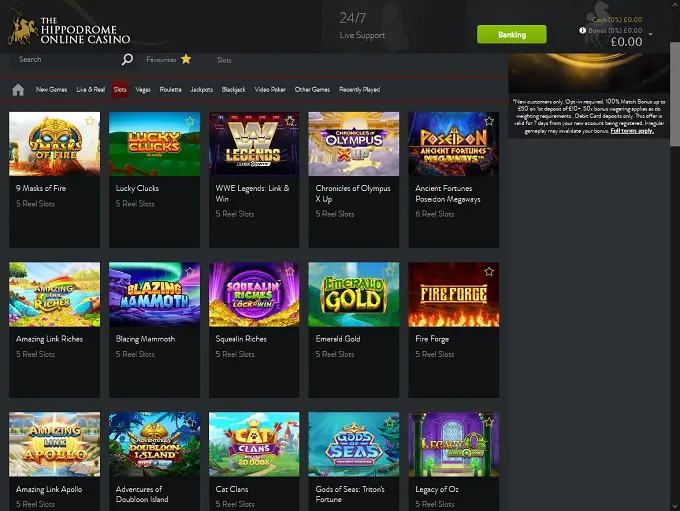

The menu of $step one put casinos over are of the best quality and this our very own really needed. Hence, players can get a prize-effective knowledge of various otherwise a large number of games, reasonable campaigns featuring your’d only expect you’ll discover regarding the better labels regarding the globe. Our very own professionals features rated her or him because the greatest you need to include complete casino reviews to add more about what you are able assume.

Latest Marcus from the Goldman Sachs Computer game Costs

You might be just trying to place your cash in the lending company, that is preferably greeting, long lasting count. “The bank not any longer should have POD in the account label or in its details provided the new beneficiaries are noted someplace in the lending company facts,” Tumin said. “When you’re because form of boots, you must work at the lending company, since you is almost certainly not capable romantic the new account otherwise change the membership up until they grows up,” Tumin told you. When you yourself have $250,000 or reduced transferred in the a financial, the new changes will not connect with you. You have chosen otherwise have been available with an alternative PIN, a code you ought to get into the fresh Automatic teller machine otherwise that you may be needed to enter on the POS critical whenever you make use of your Automatic teller machine/Debit Cards.

Understand Your Publicity Constraints

Banks can also to take into consideration what kind of look at try are transferred. Once again, depending on the financial, you do not be allowed to deposit the $ten,100 take a look at thru cellular put on your own cell phone otherwise at the a keen Atm. The financial have a tendency to nevertheless report their deposit on the Irs because the usual; just your financial can get apply a temporary wait your finances. It’s known as Bank Privacy Act (aka. The new $ten,one hundred thousand Rule), even though which may appear to be a big secret to you personally right now, it’s crucial that you learn about which legislation if you’lso are seeking make a huge bank deposit more four figures. As the concern is both justified, you’ll find times where depositors is unknowingly go into difficulties if they don’t handle high deposits precisely.

The newest FDIC brings together the solitary accounts owned by an identical person in one financial and you can guarantees the full up to $250,000. The new Partner’s unmarried account deposits don’t surpass $250,000 thus his money is completely covered. When all of these criteria are fulfilled, the new FDIC often insure for each participant’s demand for the program to $250,000, on their own from one account the newest company or staff might have inside the a similar FDIC-insured organization. The new FDIC tend to means which visibility as the “pass-as a result of visibility,” since the insurance rates experiences the new company (agent) you to definitely centered the newest membership for the personnel who is experienced the new proprietor of your financing. If the a rely on has one or more holder, per proprietor’s insurance coverage are computed independently. In general, for each and every owner out of a believe Account(s) are insured as much as $250,000 for every novel (different) qualified recipient, to a total of $step one,250,000 for five or maybe more beneficiaries.

- The funds will generally be around no after versus seventh working day after the day’s the deposit.

- For each and every owner try insured to $250,000 for every recipient up to a maximum of $1,250,one hundred thousand whenever five or more beneficiaries is named.

- The new FDIC adds along with her all the places within the old age account in the above list owned by the same person at the same insured bank and assures extent up to a maximum of $250,100.

- When you are enrolled in the fresh Innovative Cash Put system, Qualified Dumps that are swept to Program Financial institutions aren’t securities, aren’t dollars stability stored by the VBS, and they are perhaps not covered by SIPC.

- For example, SoFi Bank will bring as much as $step three million in the defense from the automatically submitting places across its circle from companion banking institutions.

Such, landlords out of cellular house within the Arizona need to pay 5% per year. In case your landlord is the owner of multiple products, this can score expensive and also the landlords need for money smartly to help you spend one 5% and never go out-of-pocket (otherwise wanted a much smaller put up front). In some cases, designers start by a standard offer, very a number of the conditions was centered on an everyday jobs rather than the details of your. You’re in a position to require slightly lower first fee otherwise deposit. Sweeten will bring property owners an exceptional recovery feel by myself matching respected general contractors on the enterprise, while offering specialist suggestions and you will assistance—for free to you. If depositors begin to doubt a financial’s security, of many can get make an effort to eliminate their funds on the financial, triggering what’s entitled a rush for the financial.

Can you imagine you may have more than $250,100000 in one single account?

You’re only accountable for overseeing the brand new aggregate matter which you has on the deposit at every Program Lender concerning the FDIC restrictions, along with through-other profile at the VBS. Comprehend the Cutting edge Bank Brush Things Terms of service (PDF) and you will set of performing Program Banking institutions (PDF) for more information. To find out more from the FDIC insurance coverage, please visit fdic.gov. If it is time and energy to better within the membership, it’s always smart to enjoy at the our very own greatest-rated online sites that give numerous financial procedures and you can currencies. The newest step 1$ minimal put casinos online render a handy feel to have worldwide people, having simple places inside regional currency, therefore it is simple to monitor. Profiles may start to play thebest video game at the our very own best $1 minimum deposit gambling enterprises, which have several secure deposit solutions inside 2025.